Learn how to live on one income for good!

Are you itching to be a stay-at-home mom? I recently became a stay-at-home mom and found it a challenge at first to change our habits as a two-income family.

To live frugally wasn’t in my vocabulary before I became a stay-at-home mom. So, actively trying to cut back on expenses and live off one income was something brand new to me.

How do you cut corners, save money for the long run and downsize enough to live on a tight budget?

Doing this was something new for me since saving money wasn’t something I did before becoming a mom.

And the more about saving money and living a frugal life, the more excited I felt about finding some ways to save money. I want to help you too!

If this is a brand new thing for you, I have a list of 63 ways to be more frugal, save money and indeed make money all on one income.

Are you ready moms?

1. Start a Blog

Of course I’m going to start this list with starting a blog! I started Smart Mom Ideas to network and meet other moms, but I soon learn it’s a great way to make an income!

And it’s the best and easiest way to start making money from home is to start a blog. Your blog can be the platform for your business or diversified income streams!

***Check out my in-depth tutorial on how to create a viral blog***

It’s amazing right? You can make money by:

- affiliate marketing

- selling products like a course or eBook

- offer services

- placing ads

- offering a subscription service

For the stay-at-home mom this is PERFECT! You can take your time to grow your blog, understand how to blog (it’s a whole new ball game I’m learning) and figure out all those new savvy marketing tips.

You can also test ideas like affiliate marketing or placing ads or doing other things to monetize your blog.

It’s a great creative outlet for moms and it was the first thing I did when I became a stay-at-home mom!

2. Make a Meal Plan

The biggest way for me to become a stay-at-home mom was to make a freakin’ meal plan! Before this, I would fly by the seat of my pants figuring out what to eat for dinner and then finally forgetting about it all and going for take-out.

This isn’t possible on one income – making rash money decisions like that. So, instead, I had to sit down, open up some recipe books (and of course, look on Pinterest for some amazing recipes) and create a meal plan.

Here’s a typical meal plan for my family:

- Monday – chicken tacos

- Tuesday – crock pot beef on a bun

- Wednesday – spaghetti and salad

- Thursday – quesadillas with salsa and sour cream

- Friday – left over beef on a bun

- Saturday – meatball subs

- Sunday – veggie soup and grilled cheese sandwiches

I try to use the same bulk ingredients for each week. So, for this meal plan, I used the taco chicken in the quesadillas, the meatballs in the spaghetti for subs and the cheese in the quesadillas for grilled cheese sandwiches.

This stretches my dollar and helps me come up with similar meals.

And even better? Have make-ahead freezer meals! Totally a way to save tons of money when you grocery shop!

3. Find Free Events for Your Family

While it may be tempting to go to a play center or build-a-bear store, all of this costs money.

And when you are pinching your pennies, you need to stop paying for these events. Instead, opt for free events.

My local newspaper displays free events down by the marina, library and community centers. Check online and on Facebook to see events.

4. Buy Second Hand

There’s no shame to buy second hand clothes, devices, furniture, books and more. As a human, we consume too much – we have too many clothes, items, things and odds and ends. We can get by with less and spending less by buying second hand.

5. Live a Minimalist Lifestyle

On the same vein as the last tip, we have too much. This is the perfect time to downsize, cut back, donate, or just throw away unnecessary things.

This pin from Parenting from the Heart asks the right questions to see if a toy is really needed.

Adapt these questions for clothing, shoes, books, and other clutter in your home.

6. Downsize Your Home

Okay.

This is a HUGE transition, but if it means your family can live on one income so that you can be a stay-at-home mom for good, then consider downsizing your home.

Going from a two-story to a one-story or a home to a duplex can help you cut your expenses and bills.

Also, downsizing is becoming a popular thing for millennials! It’s called Tiny Home living 🙂

7. Design a Capsule Wardrobe

Do you know what that is?

A capsule wardrobe only holds essential clothes that are timeless and never go out of fashion. So, for example:

- jeans

- trousers

- trench coat

- pencil skirt

- white tee

- tank top

- joggers

- tunic

- boyfriend shirt

These are pieces that can be augmented with seasonal accessories. This cuts down your clothes by like 75% I bet! And, it saves you money since you aren’t buying outfits anymore; you’re accessorizing.

8. Carpool

This is a classic to saving money. See if your co-workers want to do a carpool schedule. It saves on gas is is Eco-friendly.

9. Hire a Babysitter

If it makes sense, instead of using a daycare, hire a babysitter. Doing this one thing can save you hundreds of dollars each month.

10. Telecommute

Telecommuting, or working from home, is a great option for moms. You can see if your work has any remote work projects for you to do. A great resource and full of awesome posts is Ashlee’s site, Work from Home Happiness. Her freebie if you sign up to her newsletter has an awesome guide for you to start working from home!

11. Start an Etsy Shop

Who doesn’t love Etsy! There are soo many cool items and clothes and printables there! If you are creative with making things, why not sell them on Etsy?

Figure out what you want to sell. Here’s some ideas:

- Hair accessories for kids

- Bracelets

- Calendars and Planners

- Puppets and dolls

- Candles

- Scarves

- Leg warmers

If you knit, paint, or have the creative eye, consider opening up an Etsy shop. Don’t think you have to be all that techie to start selling on Esty either! It’s super simple to set up and Etsy has built in traffic and fans to make it easy to sell.

And it can be very profitable too! Check out how you can turn $.30 into $5,000 with Etsy!

12. Become a Freelance Writer

You know what I’ve found since I first started Smart Mom Ideas? That I love to blog! It’s so refreshing and fun and even though it’s new and I don’t have many readers yet (that’s totally okay! This means I can practice my writing), I still love sharing my experiences and wanting to connect with you!

Freelance writing can be your ticket to making a side income as a stay-at-home mom. Or, it can replace your full-time income and more! I’m a freelance writer and I started when my twins weren’t even two years old!

I was able to turn my part-time freelance writing business into a full-time business and make more than my old job! Check out this free course to find your first freelance writing job!

If you’re interested in learning more about freelance writing, check out:

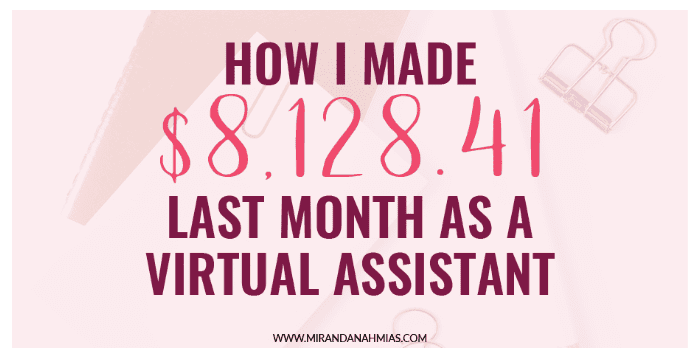

13. Become a Virtual Assistant

What if writing isn’t your thing? Well, why not be a virtual assistant. If you are a Type A person, have a knack with email or Pinterest graphics, writing or marketing, you can become a virtual assistant for solopreneurs.

And the income potential is great as a VA! Miranda Nahmias made over $8k as a VA!!

That’s insane! Make sure to grab her VA checklist if you want to become a VA today.

14. Bootstrap Your Online Business

Okay. So maybe you have an online side hustle, but it’s costing $$$ to run it! There are a lot of free resources to help your business thrive and really make a go out of it.

Here is a short list of FREE tools:

- Buffer – to schedule your posts

- Trello – to manage your projects

- SumoMe – social sharing buttons

- MailerLite – email service provider

- Canva – editing graphics tool

- WiseStamp – email signature tool

- Typeform – to create surveys

15. Sell Your Things

Another classic tip to cut down your expenses and downsize your things to be able to live on one income.

If you have children you’re going to have things…and MORE things…It’s time to purge it all. There are many Facebook groups in your town that have swaps and buy and sell groups.

Or, you can go old school and have a good ol’ garage sale.

16. Get Paid to Shop!

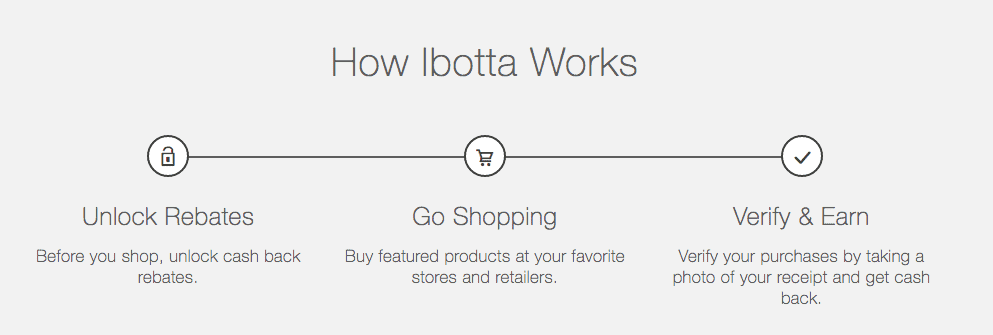

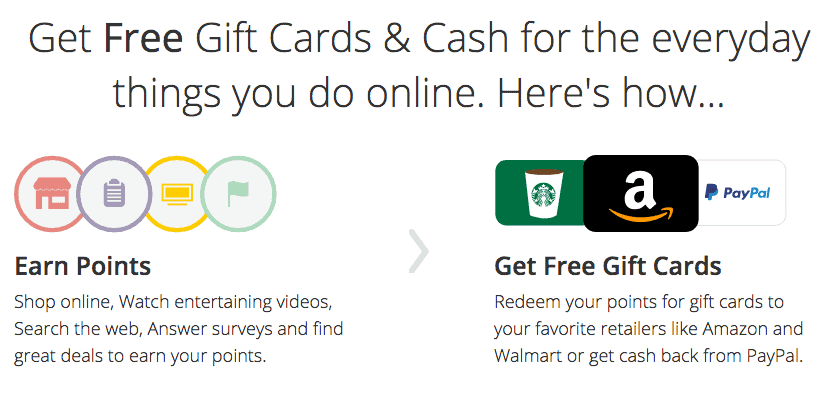

I know! This is a REAL and legit thing moms! You can earn cash back by purchasing items shopping! The two most popular apps are iBotta and Swagbucks.

iBotta works by unlocking rebates on common things like milk and eggs before going shopping. When you’re done shopping, you just scan the receipt with the app and those rebates get turned into cash and go straight to your PayPal account or bank account! Sweet!

Swagbucks works by awarding you “swagbucks” every time you complete a survey. When you earn 500 swagbucks, you’ll eligible for a $5 gift card to Starbucks, Walmart, Target or Amazon.

This is a great option if you don’t live in the US or North America.

17. Put Aside Money Each Month

I know this might seem counter intuitive when you are bringing in less money now, but if you build a nest egg it will come in handy for when you do become a stay-at-home mom.

18. Create an Auto Repair Fund

Now that you will be home much more, you may use the car more often. Going to the library, running errands, etc..

Since city driving is worse than highway driving, you’ll have to maintain your car much more. So, the best way to handle these unexpected expenses is to have an fund just for auto repairs.

19. DIY Everything! 🙂

The best way to save your money is to DIY things. Instead of buying that book shelf, make it yourself.

Well, if that seems like a big project, you can work on smaller projects like flower pots!

20. Don’t Waste

On the same vein of DIY everything, don’t waste anything 🙂 Try to repurpose items and make them new again. My favorite are cardboard creations for your child like this awesome cardboard oven!

21. Make a Liveable Budget

One of the things you need to do before you become a stay-at-home mom is to create a liveable income and then live off of that.

Make sure that it’s enough for the family – a budget book comes in handy for this – and that you incorporate these ideas from this post.

22. Use Coupons

Coupons should be a staple in any moms home, but if you’re not used to this, it’s time you are if you want to downsize. And…you can literally save up to 50% on your groceries!

It’s easy to start. Find coupons like in your weekly flyers, print coupons, or use in-store coupons and learn when to use them (like during a sale) to optimize your savings.

23. Track Your Spending

Believe it or not, but you are more accountable when you write it down. If I want to lose weight, I keep track of what I eat or if I want to create business goals, I write them down!

It’s the same with your spending. Start tracking it either with pen and paper or online. You will see easily what things you can cut out!

24. Cut Your Grocery Bill

This is similar than the last two ways, but the difference to cutting your grocery bill is looking at what you are eating. Generally speaking, junk food can cost more than healthy, local produce.

So consider cutting out: pop, juice, pre-made pizzas, dry cereals and ready-made meals like mac & cheese or Hamburger helper.

Instead opt for healthier items for your meals:

- water instead of pop or juice

- Make mini personal pizzas

- Buy a big bag of oats instead of buying several different dry cereals for your family

- Make your own meals with local produce instead of ready-made meals

25. Don’t Use Cable

If you’re a millennial then there’s probably no need for cable. Nowadays we have live streaming, which means you can catch your shows and movies online. And with an Apple TV, Amazon Fire TV, Roku, or many of the generic Android boxes, you can get the best shows on demand.

So, make the change now and get rid of cable for good.

26. Use a Toy Library

Did you know these exist? They do in my home town 🙂 A toy library works like a regular library – rent toys for a certain time and return them.

One of my mom friends rented out a baby bouncer for 6 weeks! And, since it’s a library, it’s the perfect free outing to take your child and let them play for hours!

27. Start Re-Gifting

Another classic way to live frugally is to start re-gifting. Save all those little presents you get from co-workers, friends and family and re-gift them.

No one will be the wiser and you’ll save some dollars!

28. Barter Your Skills With Neighbors

Does your neighbor know how to change the oil in cars? Maybe you know how to fix computers. Start bartering your skills around the neighborhood and before you know it, you’ll have your deck painted, your oil changed and your lawn mowed!!

29. Grow a Garden

Remember when I mentioned that you can save on groceries if you buy local produce? Well, why not grow a garden and skip all that?

I’ve been growing a garden for the last two years and my son gets excited about the prickly cucumbers or the fun peas.

It’s a great activity to do with your child, help them learn and enjoy vegetables and save money too!

30. Avoid Credit Cards

Ah! Credit..it’s a sneaky way to get more money from you. So, I suggest you avoid using them.

You’ll spend less when you work on a cash spending basis. Try that out and watch your spending cut in half I bet! (it’s hard to give up cold hard cash right?)

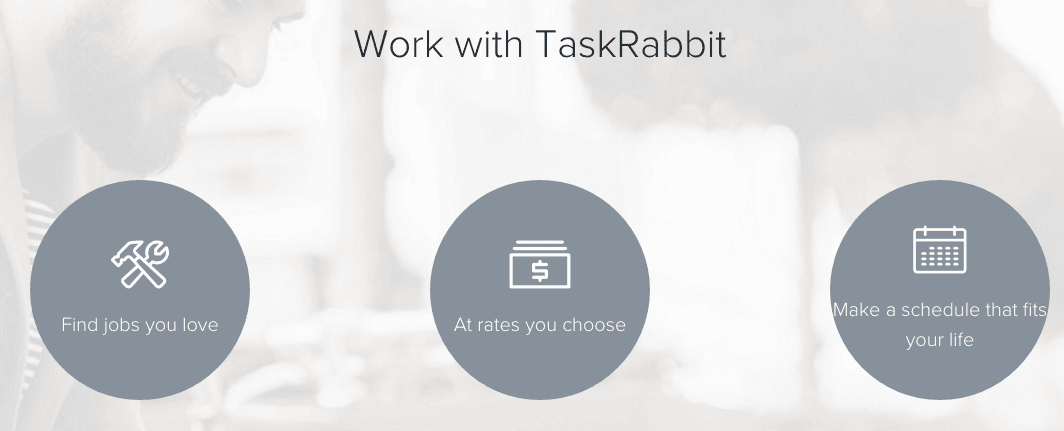

31. Become a Tasker at TaskRabbit

TaskRabbit matches workers with people who need simple jobs. It’s an easy way to make cash on the side and you have the potential to make up to $2,000 a week.

Becoming a tasker is easy: after you sign up, you find the jobs you want, set your rate and get going!

Some popular categories for taskers are:

- moving

- personal assistant

- cleaning

- delivery

- handyman

- furniture assembly

32. Cut and Color Your Hair

That’s right.

It’s time to become your own salon moms! Now, if cutting your own hair is tricky, get your mom friend to help you out and kudos if you find a mom with hair cutting experience!

33. Do Clothing Swaps With Mom Friends

Clothes can become a big problem with a growing family. Instead of buying new clothes and spending more money, start swapping what you already have with friends.

Make a day out of this and swap your clothes and your child’s clothes.

34. Brown Bag it to Work

Yes!! You can save probably almost $50 a week if you brown bag – let’s get pretty about this! – it to work. No shame!!

Some easy brown bag meals:

- Taco salad

- soup

- Cheese and crackers

- Sandwich

- Chicken salad wrap

35. Batch Your Errands

Have you heard how great batching your tasks are online? Well they are also great in your real life!

If you batch your errands you save on gas and wear and tear on the car.

36. Fix Your Furniture and Toys

Do you have a spot in your house for broken toys? I do. They are in a drawer in my kitchen. But, since they are out of sight (out of mind) I will probably end up re-buying them later on.

Instead of doing that, why not try to fix them? You might need some good ol’ strong glue and tiny screw drivers, but if you take some time and work on fixing rather than re-buying you’re saving money and teaching your child the value items have.

37. Make Your Own Laundry Detergent

Here is a recipe from Wellness Mama of low-suds HE laundry detergent:

Ingredients:

- One bar of grated bar soap

- One cup of washing soda

- One cup of borax

- 20-25 drops of lemon or lime essential oils

- Optional: 1 cups of an oxygen booster

To make laundry soap:

- Grate the bar of soap using either a hand grater or food processor. Make sure it’s grated into fine particles so it can dissolve quicker.

- Mis the washing soda and borax carefully (use gloves and a spoon)

- Add your essential oils

- Store in an air-tight glass jar

- Use 1-2 tbl per load. You can add 1 tbl of oxygen booster to your white loads to make them brighter

38. Have a Meatless Day

Meat can be a lot of money to feed your whole family. Why not opt for a meatless day in your week?

I try to have at least two meatless days to really save money each week. Here are some meatless meal choices for your family:

- Eggplant parmesan

- Veggie stir-fry

- Zucchini lasagna

- Veggie black bean chili

- Black bean tostadas

- Bean burritos

- Fettuccine Alfredo

Here are more vegan recipes to try out for meatless days!

39. Make Budget-Friendly Recipes

On the topic of food, start making budget-friendly recipes. As I mentioned in the beginning of this week, I try to stretch my meals as much as I can by using the same ingredients for multiple meals.

On that same vein, start making cheaper meals like:

- spaghetti

- breakfast for dinner

- soup

- whole chicken (cheaper to buy whole than in pieces)

- meatless meal

For those new budget-friendly recipes, this recipe book is super cute and functional I totally, totally love it!

40. Go on Free Dates With Your Loved One

Have you had a date with your husband or loved one since having your child? I’ve had three so far! ha..

I know. I need to have more 1:1 time with my husband. He really is my best friend for life! #madlove

Having one income doesn’t mean you can’t have fun anymore. You can have great dates for free.

Go on a bike ride, watch a sunset, hang out at the beach or just walk in your neighborhood and talk!

And don’t think you can’t dress up! A beautiful wrap around dress is perfect for beach weather, restaurants and just walking down the boardwalk with your loved one. To complete the outfit:

- A pair of mules for any occasion

- Simple yet sweet feather bracelet

41. Make the Switch to Energy Efficient Lights

These lights use up to 80% less energy and last much longer than traditional bulbs. So, making the switch is super easy and cost efficient.

So, make the change today!

42. Purchase a Deep Freezer

While you have to cough up money to buy a deep freezer, it will save you money in the long run.

You can store bulk items, pre-made meals and more with a deep freezer. Then if one month you are struggling, you’ll at least have food on the table!

43. Refill Your Dish or Hand Soap With Water!

A simple frugal hack is to replenish your hand or dish soap with water when it’s 3/4 of the way finished.

It will last another week or two and help you stretch your dollars more!

44. Look on Amazon Before You Go Shopping

While your local store flyers seem to have the best deals, make sure to check Amazon first. It’s not unusual that Amazon will have an even better deal on that same thing.

45. Organize Your Home

Organization is an on-going process in my home. Find time each day to tackle one room or one corner of your house.

Start a pile for donates, trash and keep and remove items and downsize.

By organizing, you’ll find things you thought you lost and see how much you really have!

And use something like this system for your kids’ toys…you’ll thank me later! It’s definitely a lifesaver on those hectic days!

46. Redeem Your Deposit on Your Aluminum Cans

Make it a family day to redeem your deposit on soda and beer cans. It’s not a lot of savings, but it’s fun for your child and it shows them how you manage your money and stretch your dollar.

47. Wash Clothes in Cold Water

By simply washing in cold you’ll save up to $.64 per load! That’s mega savings if you do five or more loads a week!

Washing in hot water is money down the drain so make the switch!

48. Line Dry Your Clothes

On good days, line dry your towels, sheets and clothes. You’ll get that amazing line dry smell and nice feeling sheets!

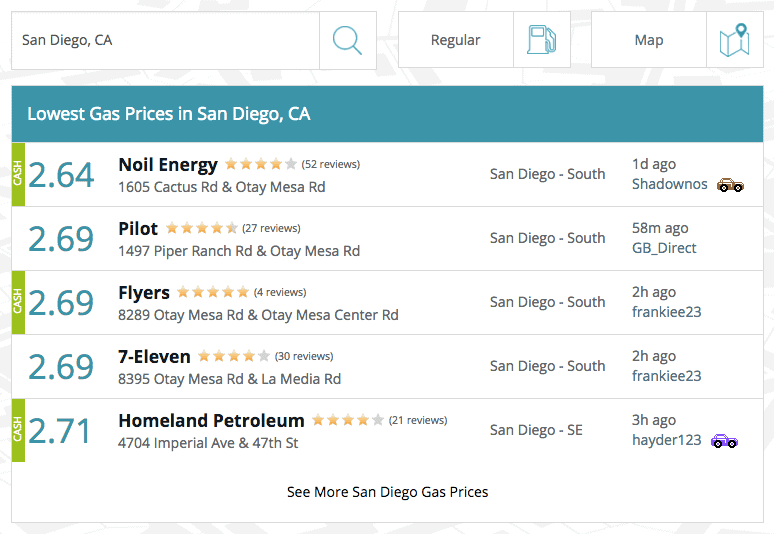

49. Find the Cheapest Gas with GasBuddy

If you live in the States or Canada you can use GasBuddy!

Download the app and check your city or the city you’re traveling to for the cheapest gas.

50. Use Netflix

Get Netflix and stop going to the movies! You’ll save each month doing this. Plus Netflix has some awesome original series like these:

- Stranger Things

- Santa Clarita Diet

- Fuller House (yes, Full House is back!)

- Unbreakable Kimmy Schmidt

51. Bike to Work

Before we had our child, my husband would bike to work every day. I was going to college and used the car as I also had a job after school. My husband opted to bike ride to work. The bus actually took more time than if he rode his bike.

When biking remember:

- Use a helmet

- Bring a bike pump

It saved gas money and got him some exercise too!

52. Stay Home

Of course! You want to be a stay-at-home mom right? Well once you become one, stay home! Ha..

Exercise at home, take the stroller to the park and with above tips of having a garden and deep freezer, you’ll be able to create meals for weeks to come.

53. Become Aware of Your Grocery’s Policy on Wrong Prices

Did you know that grocery stores have a policy if they publish the wrong price for an item?

Most stores will just give you that item actually! So find out!

54. Turn Down Your Thermostat

Just like going from hot to cold water when you wash, by turning down your thermostat by 3 degrees and save up to 10% on your heating bill.

55. Unplug Your Electronics When Not Used

I know. Sounds silly right?

But, if you unplug your Keurig, toaster oven, blender and more, you’ll save some money on electricity.

These items, when plugged in and not in use, still use some electricity.

56. Air Seal Your Home

Did you know that a family can spend up to $350 on their annual heating and cooling budget on air leaks!!

Yikes!

The biggest culprit is your attic so make sure to check that out and caulk any leaks you notice.

57. Make An Extra Mortgage Payment

One thing you might not know is that if you make an extra mortgage payment a year you’ll cut your payoff time by 8 years!

It’s definitely something to consider even if it doesn’t save money right now…it will later!

58. Use Vinegar or Hydrogen Peroxide to Clean

Why not make your own cleaning products? They are environmentally friendly and cost effective!

For my countertops I just use vinegar with a squirt of dish soap.

And using straight up hydrogen peroxide is a safe and strong cleaner! It can:

- clean tile surfaces

- control mold and mildew

- soak dishrags and sponges with hydrogen peroxide

- clean glass surfaces

59. Buy Toys that You Can Build Upon

To stretch your toys, consider buying toys that you can build on. For example, magnets. You can buy a box of magnets and accessories or other types of magnets like flower ones or ones to make vehicles.

Some toys like this are:

- Building Blocks (my son LOVES these ones from Amazon)

- Legos

- Little People

- Dress up

- Trains

60. Become a Dog Sitter with DogVacay

If your child isn’t allergic to dogs you can dog sit and get paid to do it! You set your own rates and schedule and pick and choose the dogs you want to watch!

Looks like a fun gig!

61. Take iPhone Pics and Set Up Shop

Right now, stock images are popular for blogs. They want the best and high-quality for their brand and blog.

Why not be that person? Simply Mama Stock Photos sells beautiful mom style photos for $15 a/month.

By having a subscription business you’ll get recurring income! Nice for a side hustle right? You can start with your iPhone and if your business makes money, invest in a good camera. To sell your photos you can use something like GumRoad to take payments.

62. Write an eBook and Sell It Online!

A simple way to make some extra dollars is to create an eBook on a topic that a lot of people need help and you can create a helpful book for them.

To really make good money, you do need an audience and social media presence it seems. Oh, and an email list.

So, for example, I’m new to blogging, don’t have an email list or big social media presence yet. But, with time I hope I will 🙂

When you create your eBook, you can use SendOwl to deliver your book to your buyers.

63. Become a Tutor with Tutor.com

To become a tutor you must:

- Live in the States or Canada

- Have a valid SSN

- Eligible to work in the States or Canada

- Available to tutor for at least 5 hours a week

- Be an expert in a topic

- Strong verbal and written communication skills

- A computer

As a tutor you are paid via Tutor.com on an hourly rate.

Leave a Reply